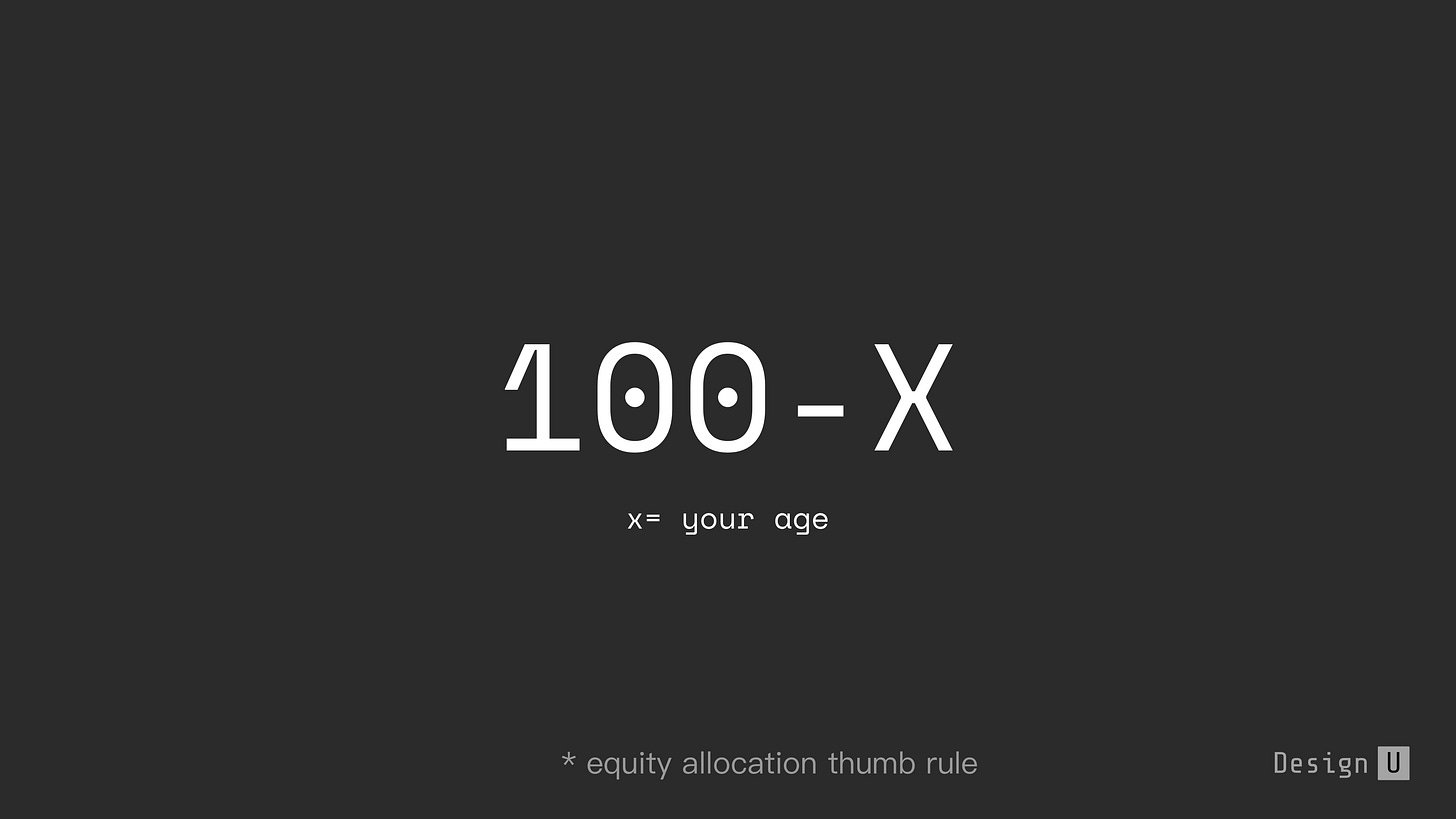

100 minus

Is the old 100 minus rule still true?

One of the basic principles of investing is to gradually reduce your risk as you get older. With old age we don’t have the luxury of waiting for the market to bounce back after a dip. A common thumb rule of 100 minus is used to simplify asset allocation to clarify how safe at what stage of life.

The rule states that individuals should hold a percentage of stocks equal to 100 minus their age. So, for a typical 40-year-old, 60% of the portfolio should be equities. The rest would comprise of bonds, government debts and other safe assets.

Couple of reasons to question the old rule.

With increasing life expectancy I’m not sure if the old rule still holds good.

The government interest rates have gone down drastically over the years. Money use to double in 6 years now takes 10 years.

Slowly the first generation middle class is on rise. With software jobs and higher literacy rate, slowly the wealth creation is higher than 50 years ago so may be the risk appetite has also increased with a wiggle room.

Concepts of pension after retirement is fading away in the corporate sector.

Retirement funds, safe investments and lower returns with the 100 minus rule to be reconsidered given the above factors. Some banks are following 120 minus now.

🥂to risk!