Hamster Wheel

So now you know a few ideas like formula for financial freedom, how to calculate your runway, having an emergency fund ready at disposal and the first principles of money. I haven’t said anything that you don’t know but discussing about the specifics brings awareness. Awareness is the only way to move to action.

Feed your awareness and action is inevitable. Now that you have a heightened awareness about your point A and point B, let us talk about typical state of affairs.

We need to talk about earn more and save more in a decoupled manner because they are two different principles. A lot of folks who earn more, are horrible savers and amazing spenders. On the other hand there are folks who are amazing savers but are horrible earners. Two different items but needs to come together that will work on your kitty.

If you have a horrible point A but you are dreaming an amazing point B, the best place to start is set the direction. Take a look at what are your sources of income. 90% of the world runs on pay check and if you belong to that category there is 90% chance that you will not hit financial independence this lifetime. I am not against employment and I am not against pay check. I am just aware of the fact that the pay checks are not designed to free you financially.

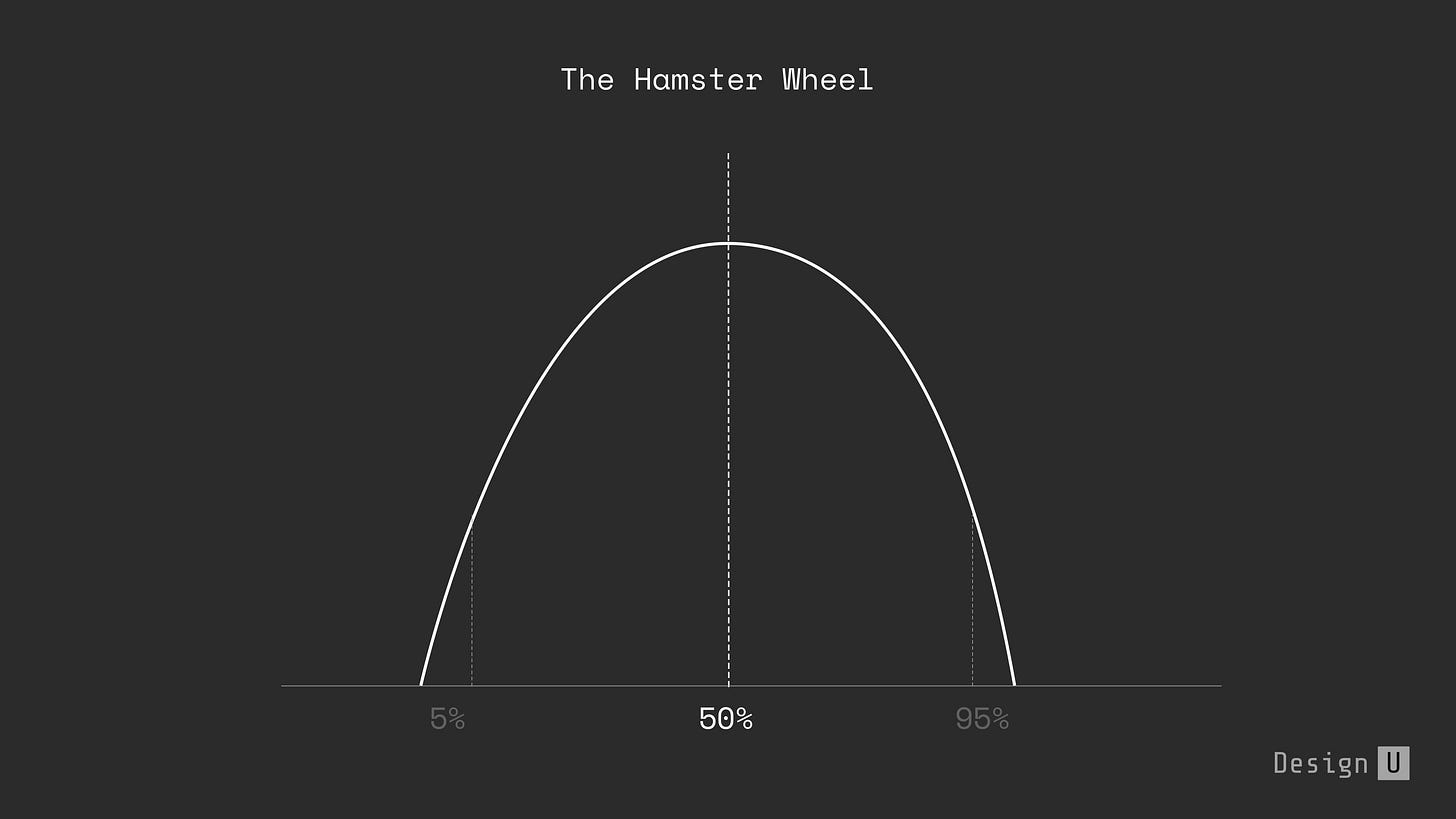

Like all bell curves even the pay check curve has extremes. The one extreme is distressed pay checks (they are so anorexic) and the other extreme, it is not a pay check anymore. The distressed end can be your driver or maid who is running on pay checks which will make you wonder how they even manage living. On the other end, it may be a Sundar Pichai or a Sathya Nadella on a pay check and you wonder, do they even need that pay check any more? If you are reading this, you will neither be here nor there. My guess is you will be in the middle (50%) of the bell curve and that is where the problem is.

Let us assume you are earning 20L per year and you are 25 now. For you to hit a 400x of 4Cr at the rate of 10% saving is gonna take you 166 years provided you were able to manage the monthly spend to the same “x” all along. Let us assume, inflation and other factors kept you at the same rate of 20K INR all along. That is generally not possible and even if it was possible, it takes 166 years to hit financial freedom. That is a lot of time. I don’t think you will be alive to see the day of financial freedom.

As a middle class Indian this is the case with 90%. They earn, they spend, they buy loans, they pay taxes, they run the economy, they make their bosses richer day by day and they keep the governments & banks working. Why will any one want to disrupt this rosy situation? and hence you are kept on the pay check for years together (even if that means your pay check is in dollars or pounds or rupees), locked up in mortgages so you will not have guts to get out of the hamster wheel ever. Now that you don’t have much ability to spend from your pay check, you will depend upon credit cards to buy a phone on EMI or a washing machine using a Bajaj finance. Now you are locked into more debt. This is how debt locks you. The first good step is to come out of this hamster wheel and start looking at things with a new pair of eyes.

As you read this at 9 am today morning, take a sip of coffee and mark your state of affairs in a sheet. Check how long will it take for you to attain financial independence in the current state of affairs. If it is anything more than 10 years, it is time to relook. This is our starting point.

🥂to the bell curve!