Investments

The right time to think about investments is when you are earning enough, able to save enough and totally debt free. Now that you have some money to invest, let us think about investment strategies.

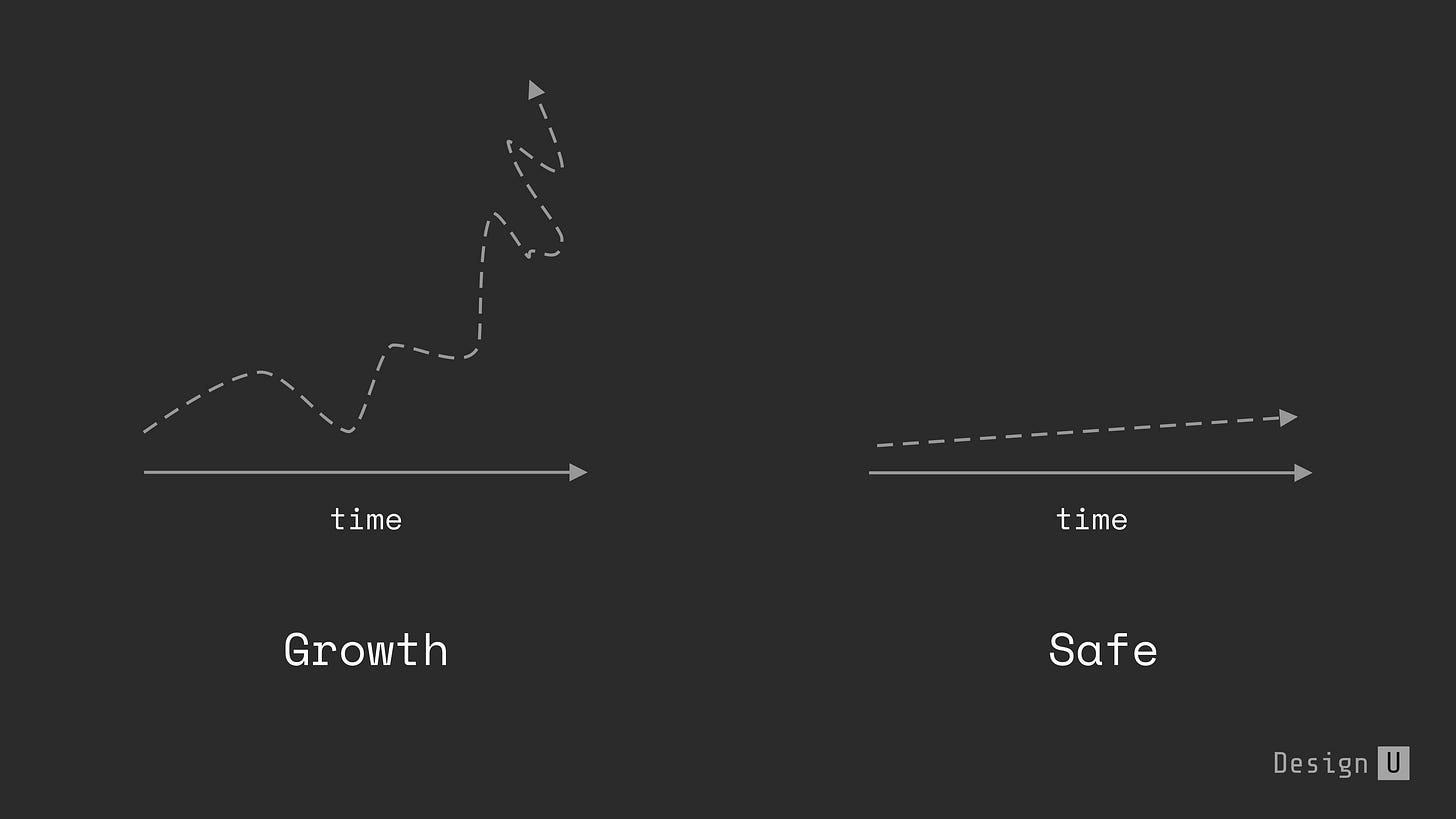

There are two types of investments you can get into depending upon your risk appetite and your goals. They are growth investments and safe investments.

Growth Investments: Suited for long term investors who are willing and able to withstand market ups and downs. The risk involved is higher in these types.

Equity and Property are considered as growth investment as they can help grow the value of your original investment over the medium to long term. The investments can also fall in value and carries the risk of losses.

Safe Investments: Suited for investors who are more focused on consistently generating income, rather than growth. As the name implies, the risk involved is lower lower than growth investments.

Cash investments like savings account, recurring deposits (RD), fixed deposits(FD) are considered as safe/defensive investments. While they give lowest potential returns they also deliver regular income. Most importantly they play an important role in protecting wealth and reducing risk in the investment portfolio.

Fixed interest instruments like bonds (government or companies) borrow money from investors and pay them a rate of interest in return. They can also be sold relatively quickly, like cash, although it’s important to note that they are not without the risk of capital losses.

Note: Investment is something that you should be able to let go without affecting your normal living. What you are ready to throw is what you should use for investment.

🥂to investments!